what is a deferred tax provision

Lets assume that a company has a book profit of 10000 for a financial year including a provision of 500 as bad debt. A deferred tax is recorded in the balance sheet of a company if there are chances of a reduced or increased tax liability in the future.

Deferred Tax Asset Journal Entry How To Recognize

The method for accounting is covered under Accounting Standard 22Ind AS 12 in india or IAS12 internationally.

. An example of when this can happen is when companies have bad debt. The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. Add or subtract net permanent differences.

Lets look at an example. Similarly it is prudent to recognize deferred. Another example of Deferred tax assets is Bad Debt.

In year 1 they buy a computer for 1800 and this is written off in the accounts by way of a. Deferred Income Tax. More specifically we focus on how government support in the form of tax incentives and tax relief might change previous assessments that were made applying IAS 12 Income Taxes IAS 12.

However this bad debt is not considered for taxes until it has been written off. Deferred income tax expense is the opposite of deferred tax assets. These taxes are eventually returned to the.

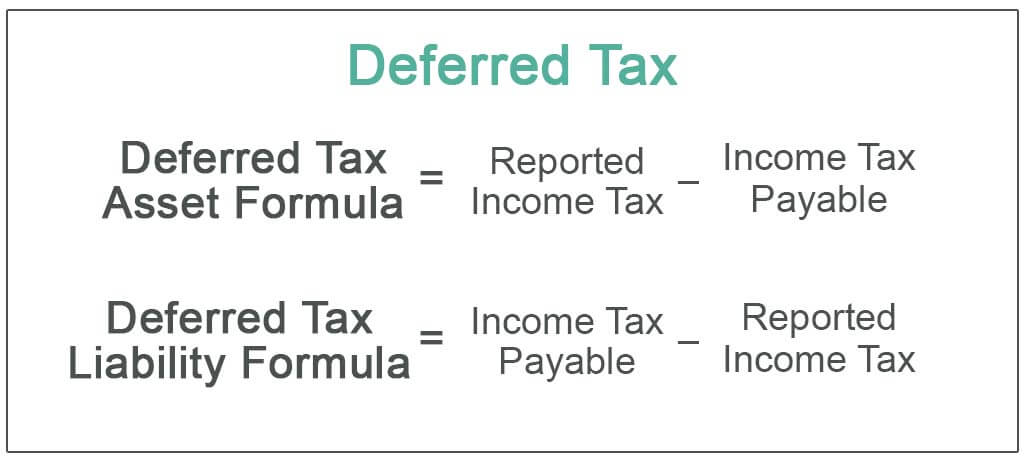

9 strangest taxes in history. Deferred tax asset is an accounting term that refers to a situation where a business has overpaid taxes or taxes paid in advance on its balance sheet. The deferred tax provision will be recorded as an expense with a related increase in deferred tax liabilities.

Deferred taxes are not recognised under the Income Tax Act 1961. Deferred income tax expense. Add or subtract the net change in temporary differences.

Start with pretax GAAP income. However they are important for accounting purposes. Deferred tax liabilities and deferred tax assets.

Answer 1 of 2. The deferred tax represents the companys negative or positive amounts of tax owed. Multiply the result by.

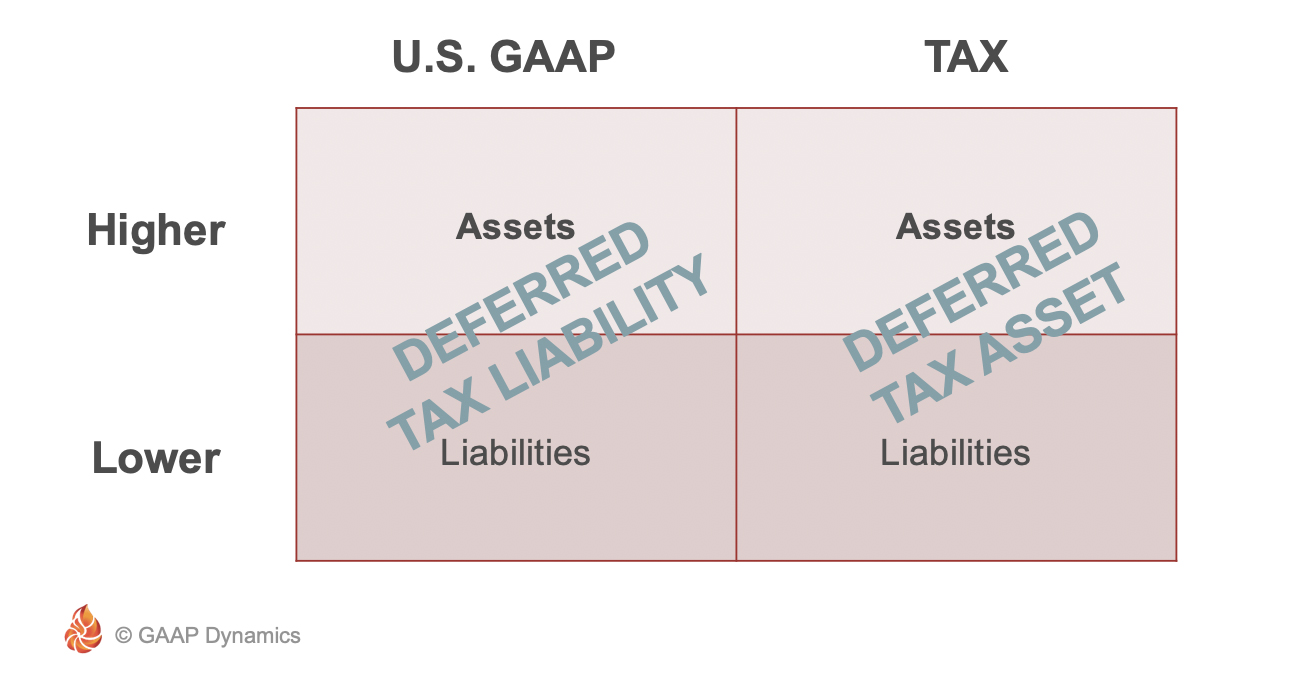

The deferred income tax expense calculates the sum total of the temporary differences and applies the federal corporate tax rate to the resulting. Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets. A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting methods.

It is important to recognize deferred tax liabilities because it helps the company be prepared for future expenses and plan its business operations accordingly. The double entry is debit deferred. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary.

Deferred tax can fall into one of two categories. The result is your companys current year tax expense for the income tax provision. Deferred tax is a balance sheet line item recorded because the Company owes or pays more tax to the authorities.

This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19. During the periods of rising costs and when the companys inventory takes a long time to sell the temporary differences between tax and financial books arise resulting in. Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed.

The deferred tax liability is currently 6000 so needs to be reduced to 4500. To estimate the current income tax provision. Thus the Company will have to pay tax on 10500 creating this tax asset.

A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. Subtract usable loss carryforwards. Say in year one your company has.

The opposite occurs when you have a deferred tax asset which is when tax expense per books is less than tax expense per tax. Deferred income taxes impact the companys future cash flow ie if its an asset the cash outflow will be less and if its a liability. A business has profits each year of 5000 before any depreciation charge.

The deferred tax provision at the end of year 1 should be 60000- 37500 x 20 4500. Its also a result of the differences in income recognition between income tax accounting rules and your companys accounting. The reason for recording deferred taxes is.

This more complicated part of the income tax provision calculates a cumulative total of the temporary differences.

Deferred Tax Double Entry Bookkeeping

Net Operating Losses Deferred Tax Assets Tutorial

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Tax Liabilities Meaning Example Causes And More

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Meaning Expense Examples Calculation

Deferred Tax Asset Journal Entry How To Recognize

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)